Working online have their positive aspects, but it additionally comes along with dangers. There are specific sectors regarded great-chance due to a assortment of factors such as the inclination towards deceptive activities, chargebacks, and-solution goods. For vendors working in these industries, it might be challenging to discover repayment finalizing providers that works along with them. That’s where higher-danger vendor accounts are available in. On this page, we check out what higher-threat vendor high risk merchant account uk accounts are, the way that they operate, the advantages they offer, and ways to choose the best one particular.

What are Higher-Threat Service provider Credit accounts?

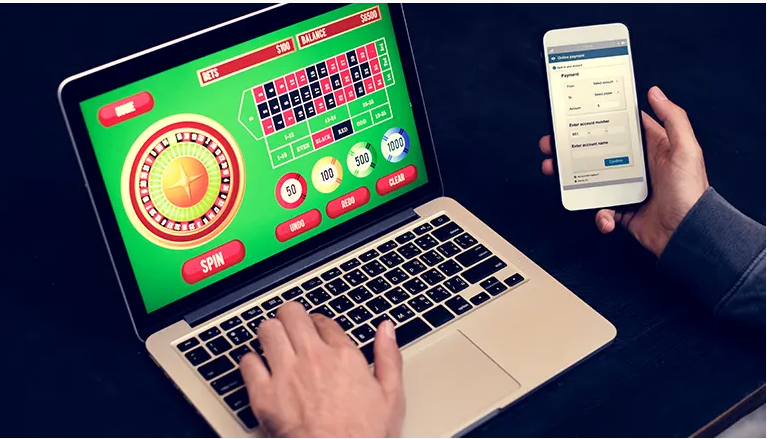

High-threat service provider balances are transaction finalizing alternatives created to assist sellers working in great-danger sectors for example gambling, adult enjoyment, pharmaceuticals, and traveling, among others. These merchant profiles help deal with the potential risks related to great-chance businesses and offer providers catered for their particular demands.

How can Substantial-Chance Service provider Credit accounts Function?

High-threat vendor balances function differently from common merchant accounts. They generally come with rigid underwriting procedures, along with the software method is often longer plus more detailed. High-threat merchant balances come with additional safeguards, including chargebacks monitoring, fraudulence protection, and chance-managing instruments, which finally minimize loss on account of fake activities.

What are the Benefits of Great-Threat Vendor Accounts?

These credit accounts give a far more substantial measure of protection and adaptability to high-threat merchants within the repayment handling sector. Several of the benefits consist of elevated repayment digesting alternatives, reduced transaction service fees, and more easy chargeback challenge quality treatments. Higher-risk merchant profiles come with risk control instruments which can help identify and prevent fraud, ultimately raising service provider profits and lowering failures.

How to decide on the best Substantial-Threat Processing Account?

Price and excellence of assistance must be major factors when picking a high-danger credit card merchant account. It would be best if you considered elements such as the amount of time the provider has been in business, the specific repayment processing options supplied, what kinds of enterprises they deal with, in addition to their customer satisfaction top quality. Attempt to recognize their price structure, which include service fees and expenses, to ensure you make an educated determination.

Simply speaking:

Navigating substantial waters from the repayment digesting sector can be challenging, especially for substantial-danger merchants. But developing a great-chance processing account can be a lifesaver. It delivers protection, works well for managing threats, and ultimately raises revenue for high-chance vendors. Comprehending these balances, how they function, and the ways to choose the right you can make a significant difference within your enterprise success. So, spend some time to shop around and choose the most effective high-risk merchant account option for the company.