Cfd trading is becoming increasingly popular among traders due to its profit potential. In this blog, we will explore the world of Cfd trading, and how it can be a lucrative investment opportunity for traders. CFD stands for Contract for Difference, which is essentially an agreement between the buyer and the seller to exchange the difference in the price of an asset between the time the contract is opened and closed. Let’s dive in and explore Cfd trading in more detail.

The first thing to understand about cfd trading is that it involves trading on margin. This means that you can potentially make larger profits than you could with traditional trading methods, but it also means that you could potentially lose more than your initial investment. It’s important to understand the risks involved with trading on margin and to have a solid risk management strategy in place.

One of the benefits of Cfd trading is its flexibility. You can trade CFDs on numerous assets, including stocks, commodities, foreign currencies, and more. This means that you can take advantage of market opportunities in numerous sectors and industries. Additionally, Cfd trading allows for short-selling, where you can profit from price decreases rather than just price increases.

Another benefit of Cfd trading is that it provides traders with access to leverage. This means that you can trade with a smaller amount of capital and potentially make larger profits. However, it’s important to note that leverage also increases the potential risk, so it’s crucial to use leverage wisely and have a solid understanding of how it works.

Cfd trading also provides traders with the ability to trade in both rising and falling markets. This means that you can potentially profit whether the price of an asset is increasing or decreasing. This is an important advantage for traders who want to take advantage of market fluctuations and increase their profit potential.

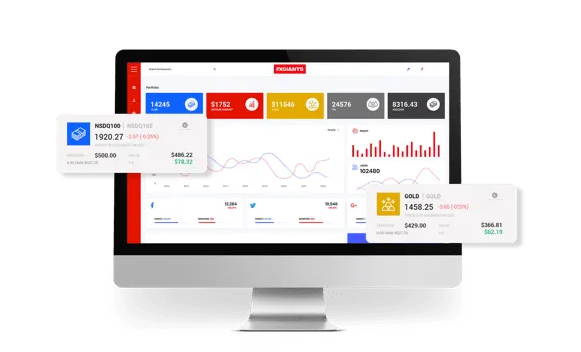

Finally, Cfd trading can be done from anywhere in the world as long as you have an internet connection. This means that you can potentially trade around the clock and take advantage of market opportunities in various time zones. Additionally, many Cfd trading platforms offer mobile apps, making it easy to access your trading account from your smartphone or tablet.

short:

In short, Cfd trading provides traders with a flexible and potentially lucrative investment opportunity. It allows traders to profit from price fluctuations in various markets and sectors, and provides access to leverage, short-selling, and trading in both rising and falling markets. However, it’s important to understand the potential risks involved with Cfd trading and to have a solid risk management strategy in place. With the right approach and the right tools, Cfd trading can be a profitable investment strategy for traders of all levels.